They say hindsight is 20/20 and that’s never truer than when it comes to the stock market.

When looking back at past corrections and bear markets, it’s natural to see all the factors that led to the downturn. However, the picture is much foggier when you’re trying to figure out when the next one might happen.

In fact, the evidence is that no one can consistently forecast the future direction of the markets – either up or down. Of course, this doesn’t prevent analysts, media pundits and investors from trying to predict the next crash.

As we’ve observed in recent episodes of our Capital Topics podcast, the doomsayers have been particularly vocal of late. They’re saying we are headed for a stock market correction or even a bear market because of the relatively high valuation levels of the markets.

The equities markets have had a strong run. For example, the U.S. market’s total return over the 10 years to January 31 was 17.8%, more than double the long-term expected return. However, experience teaches us that relative valuation metrics tell us very little about the timing of market pullback.

What are corrections and bear markets? A market correction is a drop of 10% to 20% from a recent peak. They usually don’t last very long. After a few weeks or months, the market recovers the losses. Corrections are quite normal; they allow the market to consolidate and take a breather before going higher.

A bear market is more serious. It’s when markets drop more than 20% from their recent highs. They usually last much longer. The triggers for a bear market vary greatly, but they are generally related to poor economic data, a geopolitical crisis or the bursting of a market bubble.

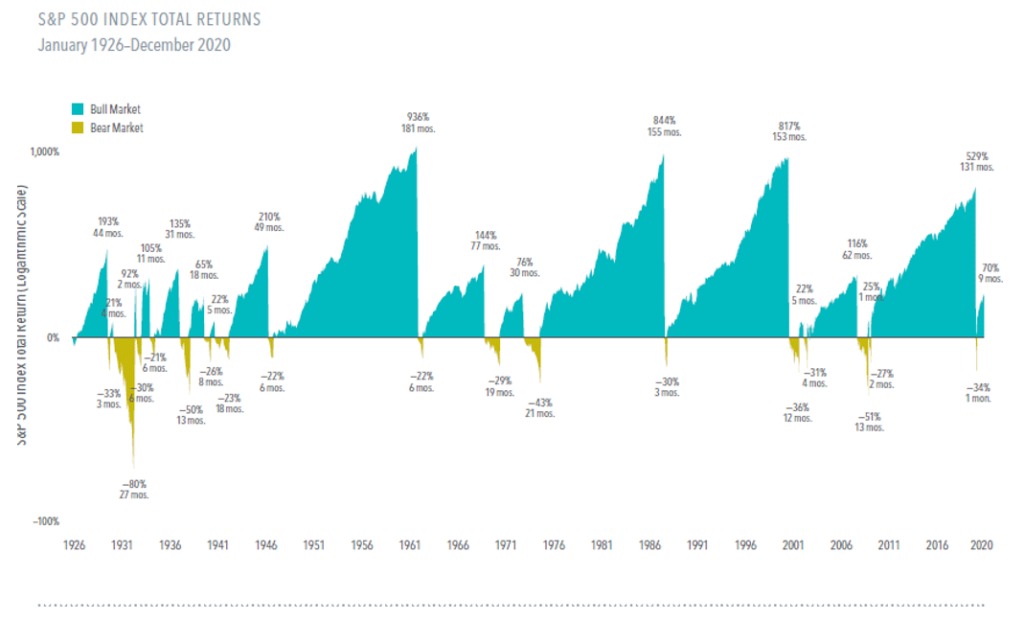

Since 1926, the S&P 500 has experienced 17 bear markets with declines ranging from -21% to -80%, according to this report from Dimensional. The average length of these bear markets was 10 months. The longest bear market was in the early 1930s, lasting 27 months, and the shortest one was the COVID crash two years ago. It lasted just one month.

As humans, we’re not wired for negative market volatility. Behavioural science has demonstrated it triggers our fight or flight instinct, and that’s why investors often make wealth destroying errors during a downturn.

Bear markets are when Investors learn their true tolerance to risk. For the long-term investor, they’re actually a time of great opportunity. But for those who panic, they almost always lead to a permanent loss of capital. That’s why it is crucial to be mentally prepared. A big drop may not happen tomorrow, this month or this year, but you can be sure one will occur sooner or later.

So, how should you prepare yourself for the next drop?