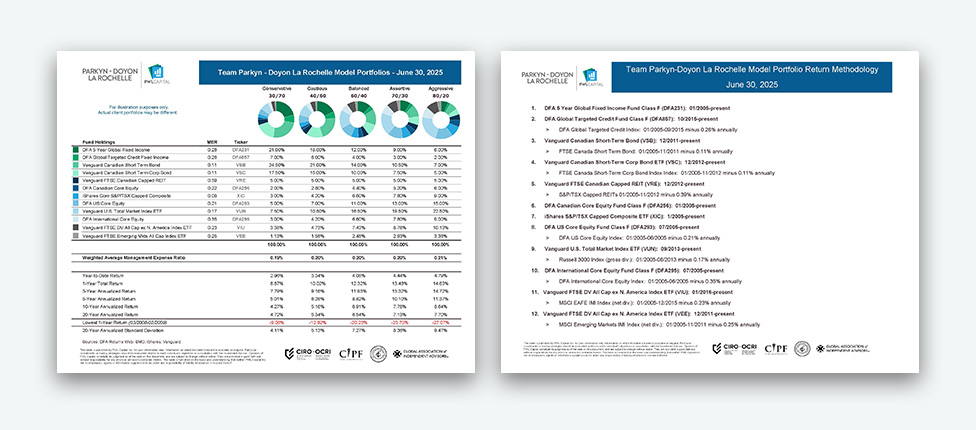

Model Portfolios – Interactive View

For illustration purposes only. Actual client portfolios may be different.

| Performance | Conservative |

|---|---|

| Year-to-Date Return | 2.96% |

| 1-Year Total Return | 8.87% |

| 3-Year Annualized Return | 7.79% |

| 5-Year Annualized Return | 5.01% |

| 10-Year Annualized Return | 4.27% |

| 20-Year Annualized Return | 4.72% |

| Lowest 1-Year Return (03/2008-02/2009) | -9.08% |

| 20-Year Annualized Standard Deviation | 4.11% |

Funds Holdings

|

DFA 5 Year Global Fixed Income

|

21.00% |

|

DFA Global Targeted Credit Fixed Income

|

7.00% |

|

Vanguard Canadian Short Term Bond

|

24.50% |

|

Vanguard Canadian Short Term Corp Bond

|

17.50% |

|

Vanguard FTSE Canadian Capped REIT

|

5.00% |

|

DFA Canadian Core Equity

|

2.00% |

|

iShares Core S&P/TSX Capped Composite

|

3.00% |

|

DFA US Core Equity

|

5.00% |

|

Vanguard U.S. Total Market Index ETF

|

7.50% |

|

DFA International Core Equity

|

3.00% |

|

December

|

3.38% |

|

Vanguard FTSE Emerging Mkts All Cap Index ETF

|

1.13% |

| Performance | Cautious |

|---|---|

| Year-to-Date Return | 3.34% |

| 1-Year Total Return | 10.02% |

| 3-Year Annualized Return | 9.16% |

| 5-Year Annualized Return | 6.28% |

| 10-Year Annualized Return | 5.16% |

| 20-Year Annualized Return | 5.34% |

| Lowest 1-Year Return (03/2008-02/2009) | -12.92% |

| 20-Year Annualized Standard Deviation | 5.13% |

Funds Holdings

|

DFA 5 Year Global Fixed Income

|

18.00% |

|

DFA Global Targeted Credit Fixed Income

|

6.00% |

|

Vanguard Canadian Short Term Bond

|

21.00% |

|

Vanguard Canadian Short Term Corp Bond

|

15.00% |

|

Vanguard FTSE Canadian Capped REIT

|

5.00% |

|

DFA Canadian Core Equity

|

2.80% |

|

iShares Core S&P/TSX Capped Composite

|

4.20% |

|

DFA US Core Equity

|

7.00% |

|

Vanguard U.S. Total Market Index ETF

|

10.50% |

|

DFA International Core Equity

|

4.20% |

|

December

|

4.73% |

|

Vanguard FTSE Emerging Mkts All Cap Index ETF

|

1.58% |

| Performance | Balanced |

|---|---|

| Year-to-Date Return | 4.08% |

| 1-Year Total Return | 12.32% |

| 3-Year Annualized Return | 11.93% |

| 5-Year Annualized Return | 8.82% |

| 10-Year Annualized Return | 6.91% |

| 20-Year Annualized Return | 6.54% |

| Lowest 1-Year Return (03/2008-02/2009) | -20.23% |

| 20-Year Annualized Standard Deviation | 7.27% |

Funds Holdings

|

DFA 5 Year Global Fixed Income

|

12.00% |

|

DFA Global Targeted Credit Fixed Income

|

4.00% |

|

Vanguard Canadian Short Term Bond

|

14.00% |

|

Vanguard Canadian Short Term Corp Bond

|

10.00% |

|

Vanguard FTSE Canadian Capped REIT

|

5.00% |

|

DFA Canadian Core Equity

|

4.40% |

|

iShares Core S&P/TSX Capped Composite

|

6.60% |

|

DFA US Core Equity

|

11.00% |

|

Vanguard U.S. Total Market Index ETF

|

16.50% |

|

DFA International Core Equity

|

6.60% |

|

December

|

7.43% |

|

Vanguard FTSE Emerging Mkts All Cap Index ETF

|

2.48% |

| Performance | Assertive |

|---|---|

| Year-to-Date Return | 4.44% |

| 1-Year Total Return | 13.48% |

| 3-Year Annualized Return | 13.32% |

| 5-Year Annualized Return | 10.10% |

| 10-Year Annualized Return | 7.78% |

| 20-Year Annualized Return | 7.13% |

| Lowest 1-Year Return (03/2008-02/2009) | -23.70% |

| 20-Year Annualized Standard Deviation | 8.36% |

Funds Holdings

|

DFA 5 Year Global Fixed Income

|

9.00% |

|

DFA Global Targeted Credit Fixed Income

|

3.00% |

|

Vanguard Canadian Short Term Bond

|

10.50% |

|

Vanguard Canadian Short Term Corp Bond

|

7.50% |

|

Vanguard FTSE Canadian Capped REIT

|

5.00% |

|

DFA Canadian Core Equity

|

5.20% |

|

iShares Core S&P/TSX Capped Composite

|

7.80% |

|

DFA US Core Equity

|

13.00% |

|

Vanguard U.S. Total Market Index ETF

|

19.50% |

|

DFA International Core Equity

|

7.80% |

|

December

|

8.78% |

|

Vanguard FTSE Emerging Mkts All Cap Index ETF

|

2.93% |

| Performance | Aggressive |

|---|---|

| Year-to-Date Return | 4.79% |

| 1-Year Total Return | 14.63% |

| 3-Year Annualized Return | 14.72% |

| 5-Year Annualized Return | 11.37% |

| 10-Year Annualized Return | 8.64% |

| 20-Year Annualized Return | 7.70% |

| Lowest 1-Year Return (03/2008-02/2009) | -27.07% |

| 20-Year Annualized Standard Deviation | 9.47% |

Funds Holdings

|

DFA 5 Year Global Fixed Income

|

6.00% |

|

DFA Global Targeted Credit Fixed Income

|

2.00% |

|

Vanguard Canadian Short Term Bond

|

7.00% |

|

Vanguard Canadian Short Term Corp Bond

|

5.00% |

|

Vanguard FTSE Canadian Capped REIT

|

5.00% |

|

DFA Canadian Core Equity

|

6.00% |

|

iShares Core S&P/TSX Capped Composite

|

9.00% |

|

DFA US Core Equity

|

15.00% |

|

Vanguard U.S. Total Market Index ETF

|

22.50% |

|

DFA International Core Equity

|

9.00% |

|

December

|

10.13% |

|

Vanguard FTSE Emerging Mkts All Cap Index ETF

|

3.38% |